DVC Villas at DisneyLand Hotel Direct Analysis & Stats

For the first time in forever (see what I did there?), a NEW DVC resort has opened at DisneyLand! Villas at Grand Californian opened in September of 2009 and continues to be one of the most popular (and by far, the most expensive) DVC resorts.

Direct prices from Disney Vacation Club for Grand Californian are $310 per point, and on the resale market the average price is around $290 per point. (Tip: Check out ALL Resale listings for Grand Californian from every broker) So when Villas at DisneyLand Hotel was announced in 2020, there was a TON of excitement from Disney lovers that want to add points on the West Coast.

I’ve pulled every single DVC contract recorded by Orange County, CA for sales of Villas at DisneyLand Hotel and the results are below!

DVC Villas at DisneyLand Hotel Room Count & Total Points

We know that in total if sold out, Disney Vacation Club will sell 3,255,992 points for Villas at DisneyLand Hotel (Source). The total room split will be as follows:

- 32 Duo Studios (Sleep 2)

- 4 Duo Studios “Garden” Building (Sleep 2)

- 245 Deluxe Studios (Sleeps 4)

- 4 Deluxe Studios “Garden” Building (Sleeps 4)

- 1 Dedicated One-Bedroom (Sleeps 5)

- 18 Lock-off Two-Bedrooms (A “lock-off” consists of a 1 bedroom + a studio with a connecting door. So these can be booked as EITHER a studio, a one bedroom, OR a 2 bedroom)

- 20 Dedicated Two-Bedrooms

- 2 Grand Villas

How are Direct DVC Sales going for DisneyLand Hotel?

In short, DVC sales for Villas at DisneyLand Hotel are going extremely well. There have been 2,932 deeds recorded with the county for Villas at DLH between May 15th (the first ones) and August 4th.

These 2,932 deeds represent roughly 411,280 points sold so far or roughly 12.63% of all points that will be allocated.

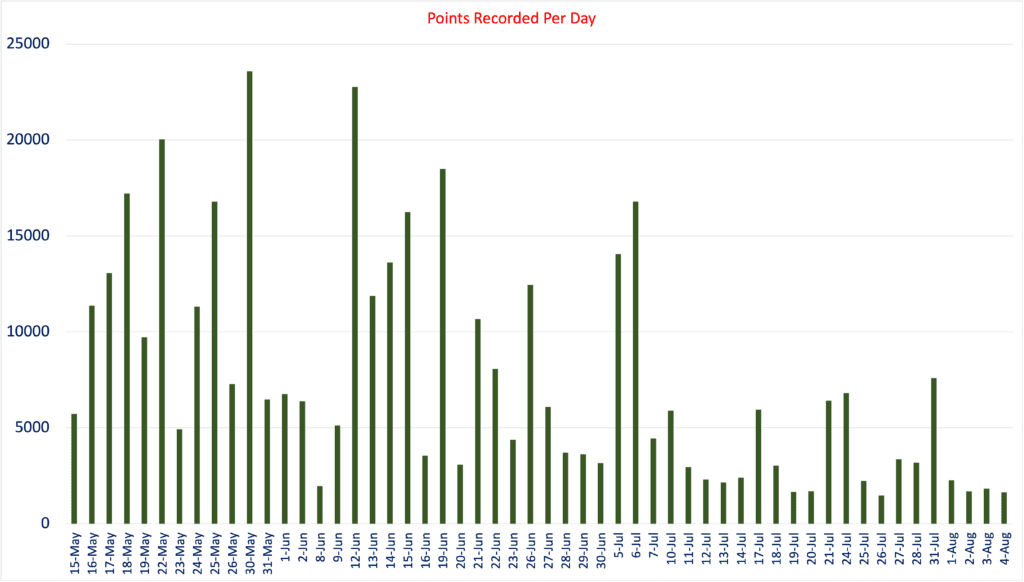

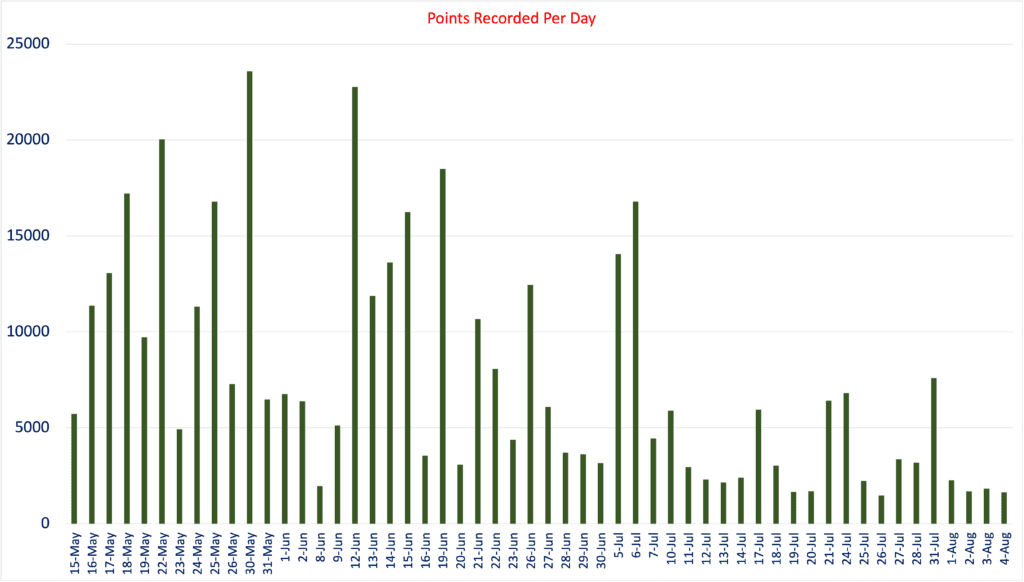

As you can see in the bar chart, sales are slowing down after the initial burst of sales from everyone who has been waiting years for a new West Coast DVC option.

It’s worth noting that the charts show the date a sale was recorded with the county (That’s why weekends and holidays don’t show any data). This is NOT when the points were SOLD. It takes some DVC members time to line up financing for their DVC contract, so that can delay the contracts being filed with the county.

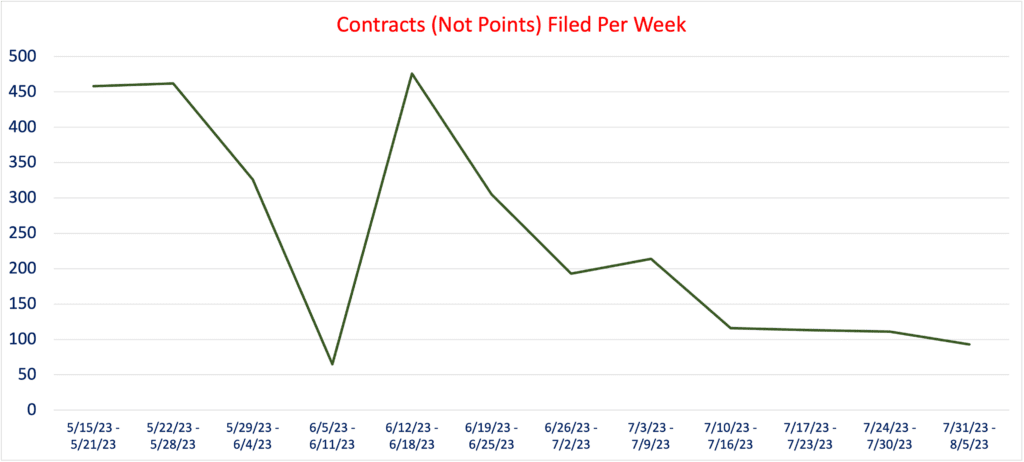

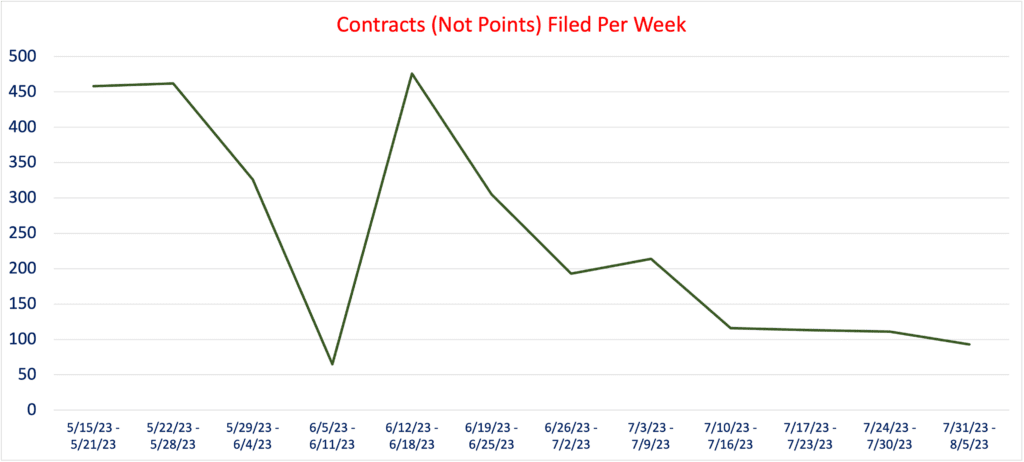

You can also see in the line chart that the week between 6/5 – 6/11 had a drop off. This is because despite being week days, 6/5 – 6/7 all had zero filings with the county. I don’t think that any filings are missing, I think it’s just a matter of filings being delayed by a few days.

The most popular contract size is 150 points (894 of the 2,932 contracts are 150 point contracts). The average contract size is 140 points. The largest contract sold so far has been 1500 points. Interestingly: There have been two 1500 point contracts sold, and both were sold to the same buyer!! In total, there have been 20 contracts sold so far that are 500 points or higher.

Method for obtaining data on Direct DVC Sales for Villas at DisneyLand Hotel

You might be wondering how these numbers were obtained or why you should trust them, so I’ll explain. Orange County, CA does not post most of the details and images of each contract online, however, you CAN do a search for Grantor or Grantee, and see basic results that include the filing document number, the recording date, the number of pages in the recording, the document type, the parcel number, the transfer tax, the “unit”, the grantor, and the grantee.

Most of these fields are self explanatory:

- Document Type for all of these will be “Grant Deed”

- Parcel Number for Villas at DisneyLand Hotel is 12932119 (Worth noting: Villas at Grand Californian looks to have a parcel number of 98819024 and there have been 12 direct contracts sold by Disney between June and July ’23)

- The Document Transfer Tax is a tax paid based on the sale price. Orange County charges 55 cents per $500 of value. This is the key to calculating how many points were sold. We can figure out how much a buyer paid with the formula:

DocumentTransferTax / .55 * 500

Once we know how much was paid, we just divide by $230 (the cost per point) to get the total number of DVC points bought because it does not look like incentives from Disney are factored into the DocumentTransferTax amount.

It’s worth noting that this isn’t exactly perfect. There are cases where the math comes out to 176.08 points for example. In these cases and to get as close to accurate as possible, I have rounded to the nearest multiple of 5. So while I’m sure there are some cases of DVC Buyers purchasing strange contract sizes like 87 points, the rounding should roughly even out.

I wrote some code to download each of the contract details and load it into a database for analysis. The full PDF of results (I removed the Grantee’s names because privacy) is here if anyone is curious to scroll through 72 pages of data.

Predicting the future: What will this mean for DVC prices?

Obviously, predicting the future is challenging, but with the great start that DVC has had with Villas at DisneyLand Hotel, I wouldn’t be surprised to see them pull back on some of the incentives for Villas at DisneyLand Hotel when the current discounts expire on September 11th, 2023.

Disney will likely want to be close to closing out Grand Floridian or Riviera before starting to sell whatever they plan to call the Polynesian Tower.

So I predict continued strong incentives for Riviera and VGF, and that they will reduce incentives for Villas at DisneyLand Hotel, by a bit.

Is a direct contract at Villas at DisneyLand Hotel a good investment?

This is a great question – The DVC Resale industry has seen sky-high prices for Villas at Grand Californian over the past several years. Even with the 3.2M points being added on the West Coast, there is still a tiny number of points available with a DVC home resort in CA vs Walt Disney World.

The dues for Villas at DisneyLand Hotel are not cheap at $9.06 per point, and on top of that, you have to pay the Transient Occupancy Tax when you use your points of $2.73 per point! That Occupancy tax will add up. If you are using 150 points per year, that is $409.50 per year for the tax that you will have to pay for your stay, in addition to your annual dues. Worse: That amount per point isn’t fixed permanently and is likely to rise over time.

Despite the occupancy tax, points on the West Coast are likely to be a hot commodity for decades to come, and DVC contracts typically hold their value or increase in value over time. So my conclusion: It probably isn’t the best pure investment strategy for your money, but if you will actually use and enjoy the points, there isn’t going to be a less expensive way to have world class accommodations for years to come at DisneyLand.